In our last blog post we discussed the VA requirements for verifiable income. VA Rules on Verifiable Income: Commissions. For example, if your home is 1,600 square feet, your maintenance and utilities cost is $224 per month. Multiply the square footage by the VA's predetermined allowance of 14 cents per square foot to find maintenance and utilities cost. The VA appraiser that appraises the home can verify this information for you in an appraisal report. The VA loan is for primary residence only, while a conventional loan can be used to purchase a primary home, as well as to purchase a second home perhaps a vacation home and you can. Donna Bradford, an assistant vice president of Navy Federal Credit Union said. In the VA loan vs conventional loan decision, the type of property you’re buying is the primary factor. In order to qualify for a VA loan, you must meet a specific residual income threshold, which varies depending on the size of your family and where you live. 2022 Military Pay Charts 2022 Defense Budget 2022 Military Pay COLA Watch 2022-2023 Military Pay Calculator. all schools relay swimming 2022ĥ Benefits of a VA Loan 2022 BAH Rates BAH Calculator Money & Finance. The veteran still has $80,100 of entitlement available. Since we previously determined that veterans have a total entitlement of $127,600 that would mean that $127,600 – $47,500 = $80,100. Thus, $47,500 of eligibility was used up in the first mortgage. Using the VA calculation that 25% of the home loan is guaranteed, $190,000 x 25% = $47,500. Credit scores don’t count as much with VA loans as they do with conventional loans, but you’ll still need pretty good credit to finance a home purchase with the VA. And remember, while the VA cares more about your residual income than about your DTI, the bank that gives you your VA loan will have its own DTI requirements. Disclaimer: HUD makes changes to their FHA. But there are exceptions to these rules, as noted above. This means the monthly housing payments should not exceed 31% of gross monthly income, while the total debt burden should not exceed 43% of monthly income. To recap, FHA's maximum qualifying debt ratios for borrowers in 2021 are 31% and 43%. Labor Department's Bureau of Labor Statistics will release the Consumer Price Index.

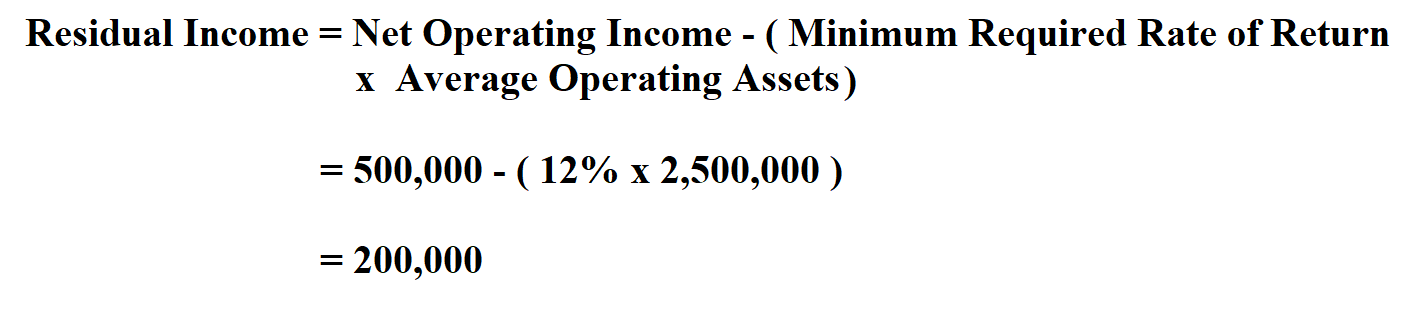

2022, to adjust for inflation and calculate the cumulative inflation rate through May 2022. Get inflation rates and US inflation news. Easily calculate how the buying power of the US dollar has changed from 1913 to 2022. The table below shows the residual income requirements for loan amounts above $80,000. The requirements vary based on your family size, the size of your home and location of the property.

#Residual income calculator free#

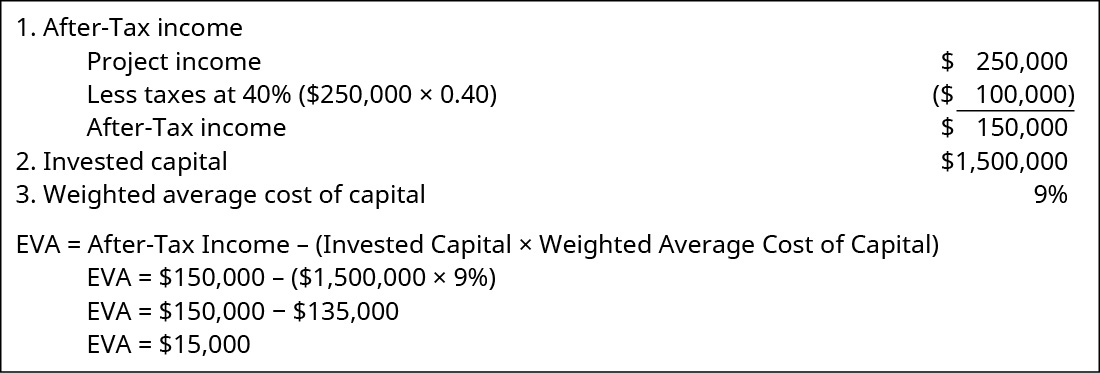

VA lenders use a residual income calculator to determine how much free cash you have each month, after paying your monthly obligations from your after-tax income. However, these guidelines allow for higher ratios of up to 56.9% with compensating factors. The DTI guidelines for FHA mortgages allow for a maximum of 43%. Proposed monthly property taxes, insurance and HOA fees = $475. VA home loan requirements recommend a DTI ratio (calculated by dividing total monthly debt - including your (9) Using residual income when DTI is too high As part of the VA mortgage approval process, your mortgage lender will compare your monthly, verified income to (10). VA Loan Requirements in 2022 | LendingTree. Please remember that this is an estimate, the actual fees and expenses may change depending on a variety of factors including the actual closing date, your.

Enter your closing date, the sale price, your military status & quickly see the monthly costs of buying a home. Use this calculator to help estimate the monthly payments on a VA home loan. The VA would like to see 41% DTI or less. DTI: The “Debt-to- Income Ratio” requirements of lenders can vary. Divide: Debt Income = Debt-to- Income Ratio. Income: $10,000 month in income * Non-Taxable income may be “grossed up” for purposes of calculating the debt-to- income ratio, but not for residual income calculations.

0 kommentar(er)

0 kommentar(er)